Reserve

You’ve learned so far about the basic mechanics of data

markets. The MarketToken tracking ownership, the

voting mechanism, the process for getting listings

accepted into the market. You now understand that a

maker submits a listing candidate on-chain (and sends

the data off-chain to the datatrust). If accepted, the

maker is rewarded listing_reward of MarketToken.

You might now be asking yourself, why would anyone

bother? This MarketToken is a new ERC-20 token that

no one has heard of. Why does it have any monetary

value?

The answer to this question is that the MarketToken

for a particular data market is backed by the Reserve

for that data market. You can think of the Reserve as

the “bank account” tied to each data market. It holds

the funds tied to that data market and serves as

incentive for makers to contribute the market. These

funds are denominated in EtherToken (which if you

recall, is 1-1 equivalent with ETH). Holders of

MarketToken are authorized to their fair share of

these funds, which means that MarketToken is directly

redeemable for ETH. Since ETH has real value (in $), it

means that MarketToken has real value, so long as the

Reserve isn’t empty.

You might now say, that’s all well and good, but why

would anyone bother putting any money into the reserve?

What’s in it for them? You got a clue in the last

chapter; when buyers purchase data, a fraction of the

payment is sent to the reserve. Think of this as the

fee that the data market takes for facilitating the

data transaction. This means the reserve holds a

fraction of earnings from the data in the data market.

As the data in a data market is used more and more, the

Reserve builds up funds, just like a company whose

product is widely purchased builds up funds in its bank

account.

It’s also important to emphasize that data purchases

aren’t the only way the Reserve can gain funds.

You’ll learn more about patron support in the next

section. The remainder of this chapter introduces the

basics of the reserve for a data market. In addition to

discussing patronage, it introduces the “algorithmic

price curve,” the market making mechanism which allows

stakeholders to buy or sell MarketToken at all time,

and discusses the smart contract code backing the

Reserve.

Patrons

Who is a patron? Following the dictionary definition, a patron is an individual with funds who wishes to support a worthy cause. For example, a rich patron of the arts may pay for artists to follow their dreams and make beautiful works of art. Although we don’t usually think of them this way, a venture capitalist could also be viewed as a type of patron, supporting the growth of companies they believe in (while hoping to make a healthy return of course). A patron may be driven by different motives, altruistic or economic, but the mechanics are the same in either case. A patron is an entity who transfers funds to other individuals to support their work.

Thanks to the algorithmic capabilities of smart

contract systems, we can formalize this transfer in

code. In particular, a patron is an entity who

transfers funds to the Reserve for a data market. Why

would the patron do this? In our case, it’s because the

patron receives an amount of newly minted MarketToken

in return for their contribution. Rather than being

overly descriptive, let’s just take a look at the

Reserve.support() function.

@public

def support(offer: wei_value):

"""

@notice Allow the purchase MarketToken with EtherToken priced according to the "buy-curve"

@param offer An amount of Ether Token in Wei

"""

price: wei_value = self.getSupportPrice()

assert offer >= price # you cannot buy less than one billionth of a market token

self.ether_token.transferFrom(msg.sender, self, offer)

minted: uint256 = (offer / price) * 1000000000 # NOTE the ONE_GWEI multiplier here as well

self.market_token.mint(minted) # TODO maybe implement `mintFor()`

self.market_token.transfer(msg.sender, minted)

log.Supported(msg.sender, offer, minted)

Here offer is the amount of funds the patron is

offering to the data market. The function computes the

number of MarketToken that should be minted for this

offering by by consulting the “algorithmic price curve”

to obtain the current exchange rate (more on this

shortly). Note that offer is in units of

EtherToken wei. The returned value will be in terms

of MarketToken wei. offer is added to the data

market reserve and the returned MarketToken is newly

minted.

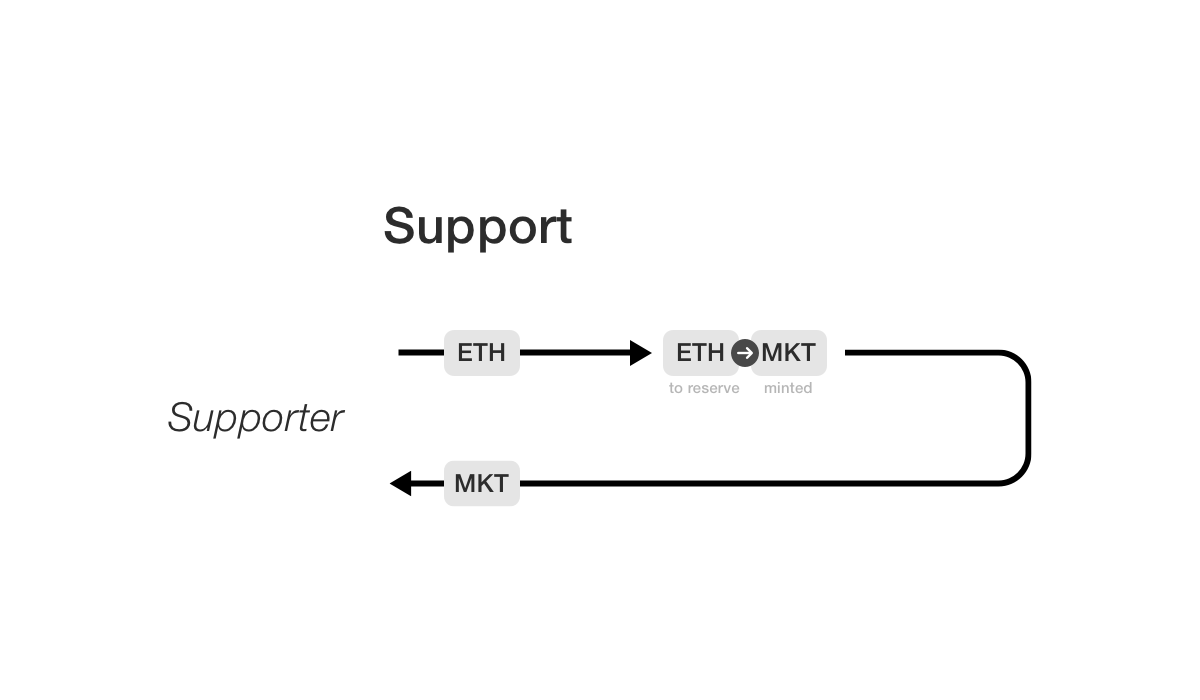

Let’s take a look at a diagram that illustrates the core idea:

You might ask, what about the reverse operation? What

if I supported a data market as a patron, but

something’s changed and I no longer have believe that

this market is worth my support. Is there any way for

me to recoup my funds? In the physical world, this

might have to involve lawyers and lawsuits, but in our

case, we can create algorithmic rules which allow for a

clean withdrawal. Let’s check out the

Reserve.withdraw() function:

@public

def withdraw():

"""

@notice Allows a supporter to exit the market. Burning any market token owned and

withdrawing their share of the reserve.

@dev Supporter, if owning a challenge, may want to wait until that is over (in case they win)

"""

withdrawn: wei_value = self.getWithdrawalProceeds(msg.sender)

assert withdrawn > 0

# before any transfer, burn their market tokens...

self.market_token.burnAll(msg.sender)

self.ether_token.transfer(msg.sender, withdrawn)

log.Withdrawn(msg.sender, withdrawn)

Reserve.withdraw() burns all the MarketTokens

associated with its caller and withdraws

their share of the reserve (the percent of reserve

withdrawn equals the percent of MarketToken this

stakeholder owns).

More precisely, the fractional ownership this

stakeholder has is num_tokens/total_num_tokens where

num_tokens is the number of MarketToken the

stakeholder owns, and total_num_tokens is the total

number of MarketToken out there. For example, if

num_tokens=5 and total_num_tokens=100, this would

be 5% fractional ownership. Then num_tokens market

tokens are burned. Then the fractional part of the

reserve belonging to this stakeholder is transferred to

them. In the case above, 5% of the reserve

would be transferred to the stakeholder’s address.

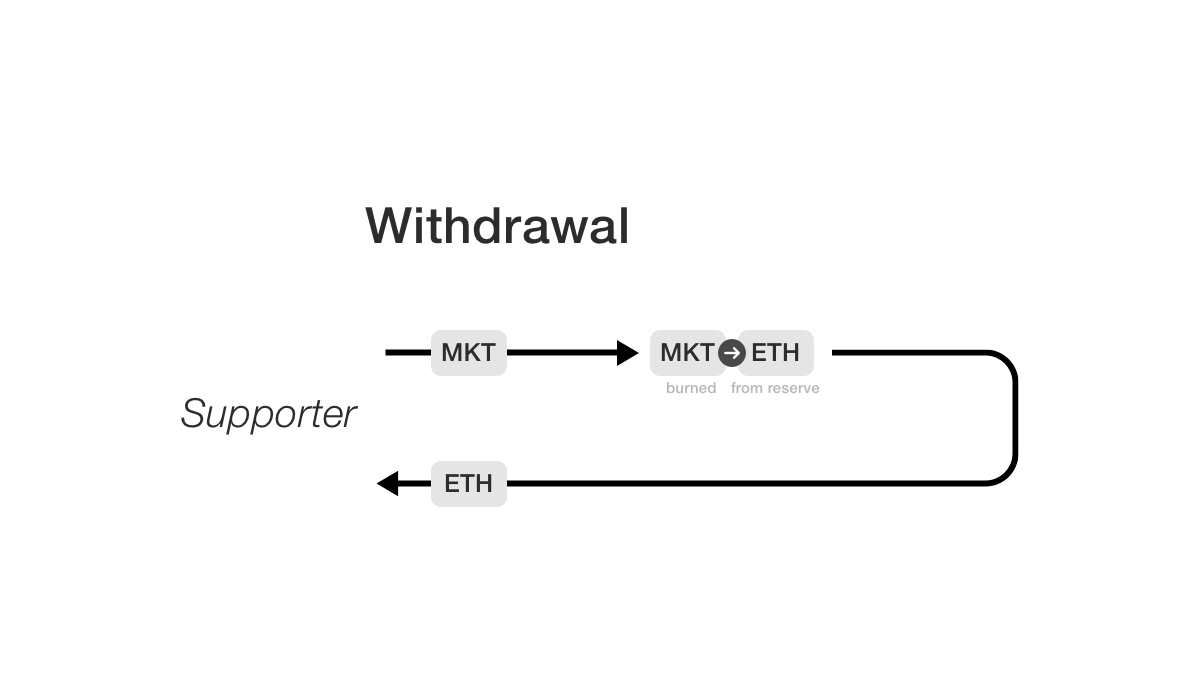

Here’s a diagram that captures the core flow:

There’s a really important point to make here. There’s

nothing in this function which checks that the caller

was a patron! In particular, makers or any stakeholders

in the market are permitted to call

Reserve.withdraw(). This brings a really powerful

feature to the data market. Any participant can choose

to exit the data market at any given time. This means

patrons can leave when they wish, and so can makers. In

addition, when leaving, they are allowed to leave with

their fair share of the Reserve, real EtherToken

which can be converted to ETH and subsequently to

dollars. This means a data market is a very liquid

entity since participants can opt-out at any time.

Algorithmic Price Curve

In the discussion in the previous section, we briefly

mentioned that patron calling Reserve.support() has

MarketToken minted according to the current exchange

rate. In the code, we invoked the function

Reserve.getSupportPrice() to obtain this price but

didn’t say much about its details. This function

implements what we call the “algorithmic price curve.”

It’s a way to get an algorithmically defined exchange

rate between MarketToken and EtherToken. This is an

extremely powerful tool, since it means that a data

market can bootstrap itself from 0. In systems without

an algorithmic price curve, an external party such as

an exchange has to dicate the conversion price. This

creates greater barriers to getting a new system off

the ground.

You might now be wondering how the algorithmic price

curve actually works. We’ve already given a few hints.

The Reserve.withdraw() function allows a stakeholder

to withdraw their fractional share of the reserve. If

they own something like 5% of all MarketToken for

that market, they are entitled to 5% of the reserves

EtherToken, which converts to ETH. This sets a direct

conversion from MarketToken to ETH, which sets a

minimum price for MarketToken, since it’s worth at

least that basic amount of ETH. Should we then have the

algorithmic price curve basically return this amount of

ETH?

This isn’t too far off from what the algorithmic price

curve does, but there’s a couple subtleties. First,

there’s initial condition issues. If the Reserve is

empty, say at the birth of the market, what is the

price of MarketToken? If it’s 0, that makes no sense

since it’s not clear how much patrons should be awarded

for their contribution. For this reason, there is a

price_floor parameter set by the Parameterizer,

which sets the minimum exchange rate.

There’s also one additional factor to consider. There’s

some danger in setting the price of MarketToken at

precisely its value in ETH. In particular, it makes it

easy for speculators to rapidly move in and out of the

market, which could destabilize the market. For this

reason, there’s a small “fee” which is added on. This

is governed by the spread parameter set by the

Parameterizer. This corresponds directly to the

spread

set by a traditional market maker. The spread is

awarded back into the reserve. For example, if spread

is 110, that means a 10% spread is enforced. This

creates a reward for early entrants, since they gain a

10% discount for being early to the game. This

encourages early participation in a market to help it

bootstrap.

Ok, we’ve said a lot of words, so let’s now take a look at the actual code:

@public

@constant

def getSupportPrice() -> wei_value:

"""

@notice Return the amount of Ether token (in wei) needed to purchase one billionth of a Market token

"""

price_floor: wei_value = self.parameterizer.getPriceFloor()

spread: uint256 = self.parameterizer.getSpread()

reserve: wei_value = self.ether_token.balanceOf(self)

total: wei_value = self.market_token.totalSupply()

if total < 1000000000000000000: # that is, is total supply less than one token in wei

return price_floor + ((spread * reserve * 1000000000) / (100 * 1000000000000000000))

else:

return price_floor + ((spread * reserve * 1000000000) / (100 * total)) # NOTE the multiplier ONE_GWEI

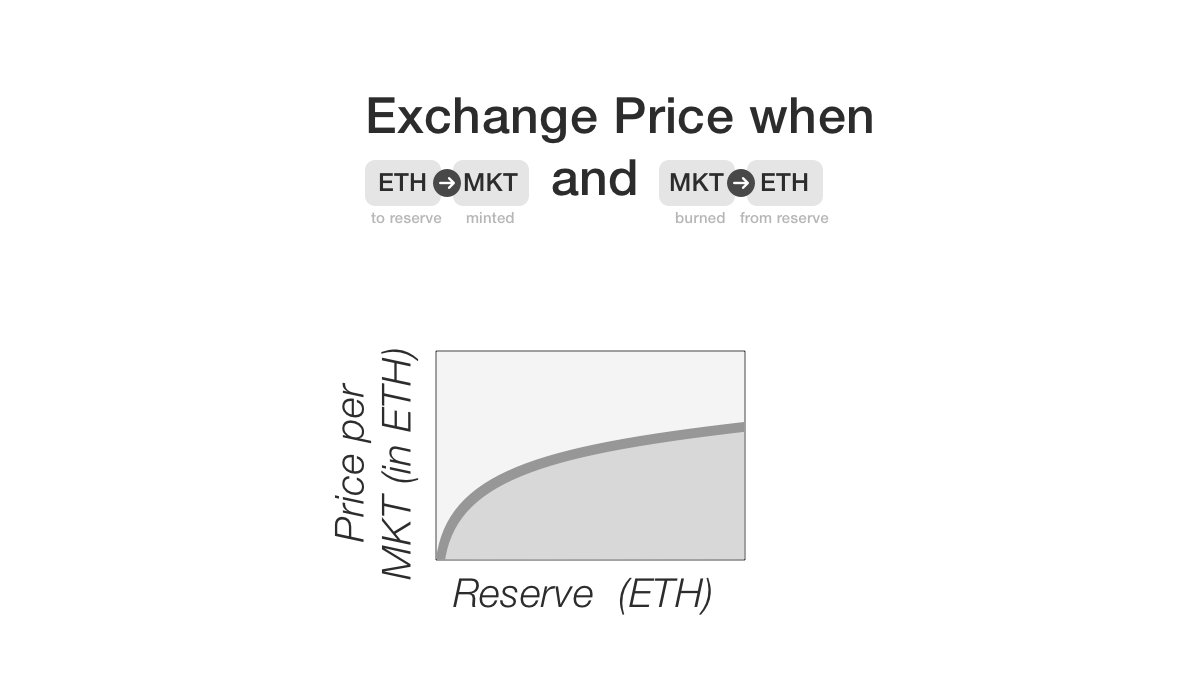

This is the most complex function in the entire Computable smart contract system. Before we dig into what the code means, it might help to take a look at this diagram to gain some basic understanding of the intuition:

Now let’s return to the algorithm. The main reason for this complexity is that today’s smart contract systems don’t support floating point. This means thata the basic math gets complicated. At heart, what we’re trying to implement is a linear function. Think of this as

price_floor + spread * withdrawal_price

The actual equations abbove are considerably more

complex. What gives? The first issue is units. Since we

don’t have floats, we have to perform computations in

wei (recall a wei is a billion-billionth, or

1/10**18). To make this work out,

Reserve.getSupportPrice() reports the amount of

EtherToken in wei needed to purchase a gwei (“giga

wei”, one-billionth, or 1/10**9) of a MarketToken.

Take a second and let your mind wrap around this.

The other complications here arise from the fact that we’re performing integer division. What is the “withdrawal price” in this case? Well, we’re purchasing a gwei of market token. How much from the reserve would that get us? Let’s pretend we had floating point:

reserve/MarketToken.totalSupply()

Ok, not bad. There’s an issue though. What are the

units of this expression? Well, reserve is in

EtherToken wei, and so is MarketToken wei. These

cancel. Our current expression is basically the amount

of of EtherToken in gwei you could withdraw for one

gwei of MarketToken. We need to multiply by 10**9

to get the amount in EtherToken wei. (Don’t worry if

this was confusing; getting unit math right is really

tricky. It took us a number of tries before we derived

the correct equation ourselves.)

(10**9 * reserve)/(MarketToken.totalSupply())

Let’s add on that price_floor. It’s just

an additional term we add on.

price_floor + (10**9 * reserve)/(MarketToken.totalSupply())

Getting a little closer. Let’s see if we can work that

spread in. A spread is a percentage (think 110 or

150 for 110% or 150%). For a spread of 110, we want

to multiply by 1.1. Or more generally, by

(spread/100). To deal with the lack of floats, we do

this:

price_floor + (spread * reserve * 10**9)/(100 * MarketToken.totalSupply())

Ok, this matches one of the equations in the code above. There’s one complication though. What if MarketToken.totalSupply() is 0? There would be a division by 0. We need some cutoff to prevent division by 0. For conceptual simplicity, we say that if MarketToken.totalSupply() is less than 1 whole MarketToken, we cap the size of the denominator to get the equation

price_floor + (spread * reserve * 10**9)/(100 * 10**18)

We’ve now succeeded in deriving the full form of the

algorithmic price curve! You might’ve gotten lost in

all this math. If so, don’t sweat it too much. The

basic intution is that the Reserve.support() price is

designed to be slightly above the Reserve.withdraw()

price at all times, with a small spread which is

awarded to the reserve. The rest of this is technical

detail.

The future of the Reserve

At present, the reserve is denominated in EtherToken.

This has the benefit of simplicity, but there are some

inconveniences. In particular, as the price of ETH

fluctuates, the value of the data market will

fluctuate. This isn’t necessarily sensible, since the

underlying market valueof the data shouldn’t be closely

tied to ETH market fluctuations. For this reason,

future versions of the protocol will likely enable ways

to construct markets whose reserves are denominated in

stablecoins.

However, this feature is not yet present in the current

version of the Computable protocol.

Last Thoughts

You’ve now begun to see the heart of the economic engine that drives on-chain behavior in the datatrust. But we haven’t yet tackled the off-chain system for actually handling data. You’ll learn more about the datatrust in the next chapter.